Abstract

Understanding inflationary pressures across euro area member states is critical for European Central Bank (ECB) policymakers to implement effective fiscal and monetary strategies. To support this, considerable research has focused on developing inflationary pressure indicators. However, many of these indicators rely on dynamic factor models that treat observations at each time point as a vector, overlooking the potential structure in the data. In this paper we propose a Bayesian Matrix Dynamic Factor Model (MDFM) in order to analyse and forecast inflation developments in the euro area on a granular level. In particular, we construct a measure of inflationary pressure in the euro area that summarizes information on sectoral inflation rates and their drivers from 10 euro area countries.

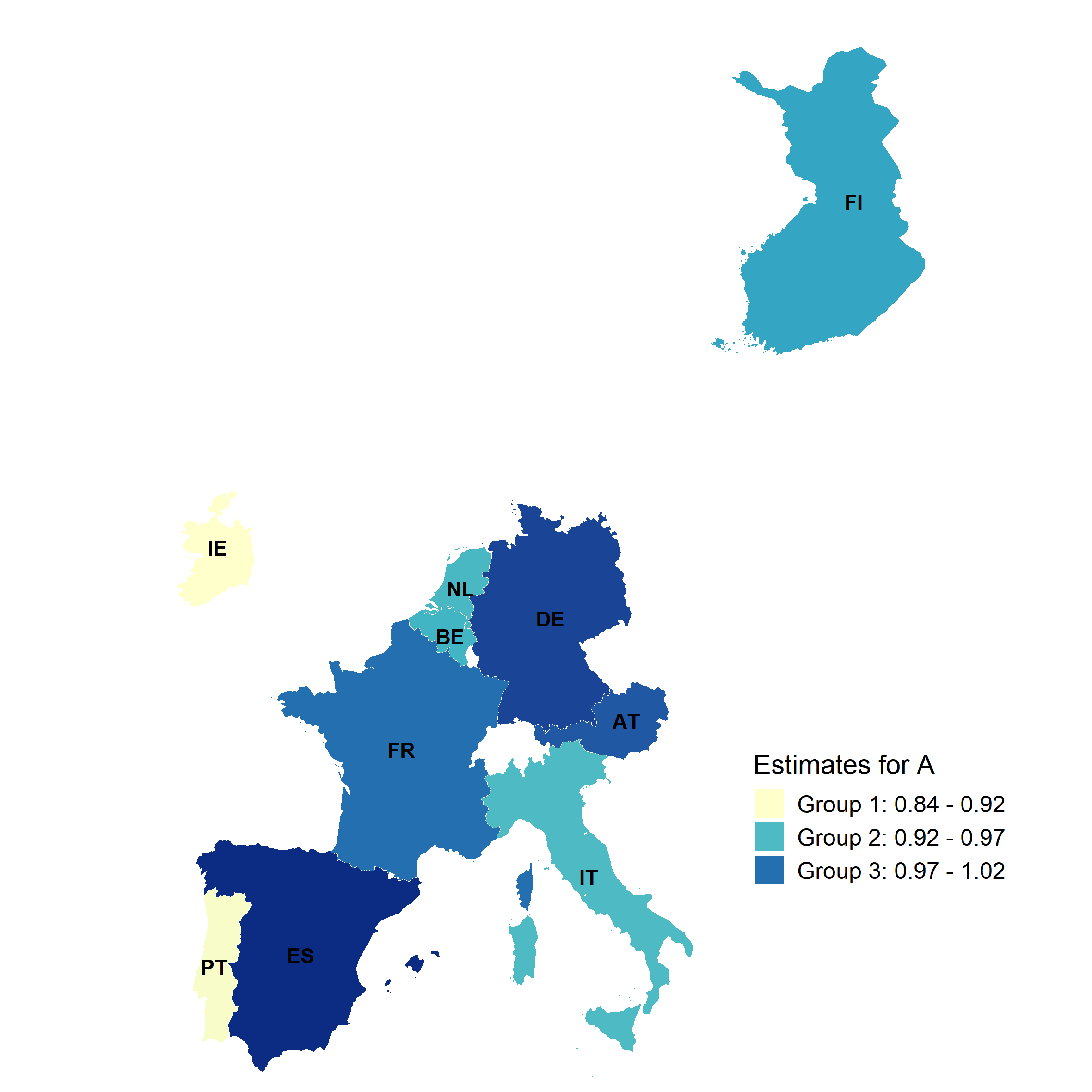

Factor Loadings across Countries

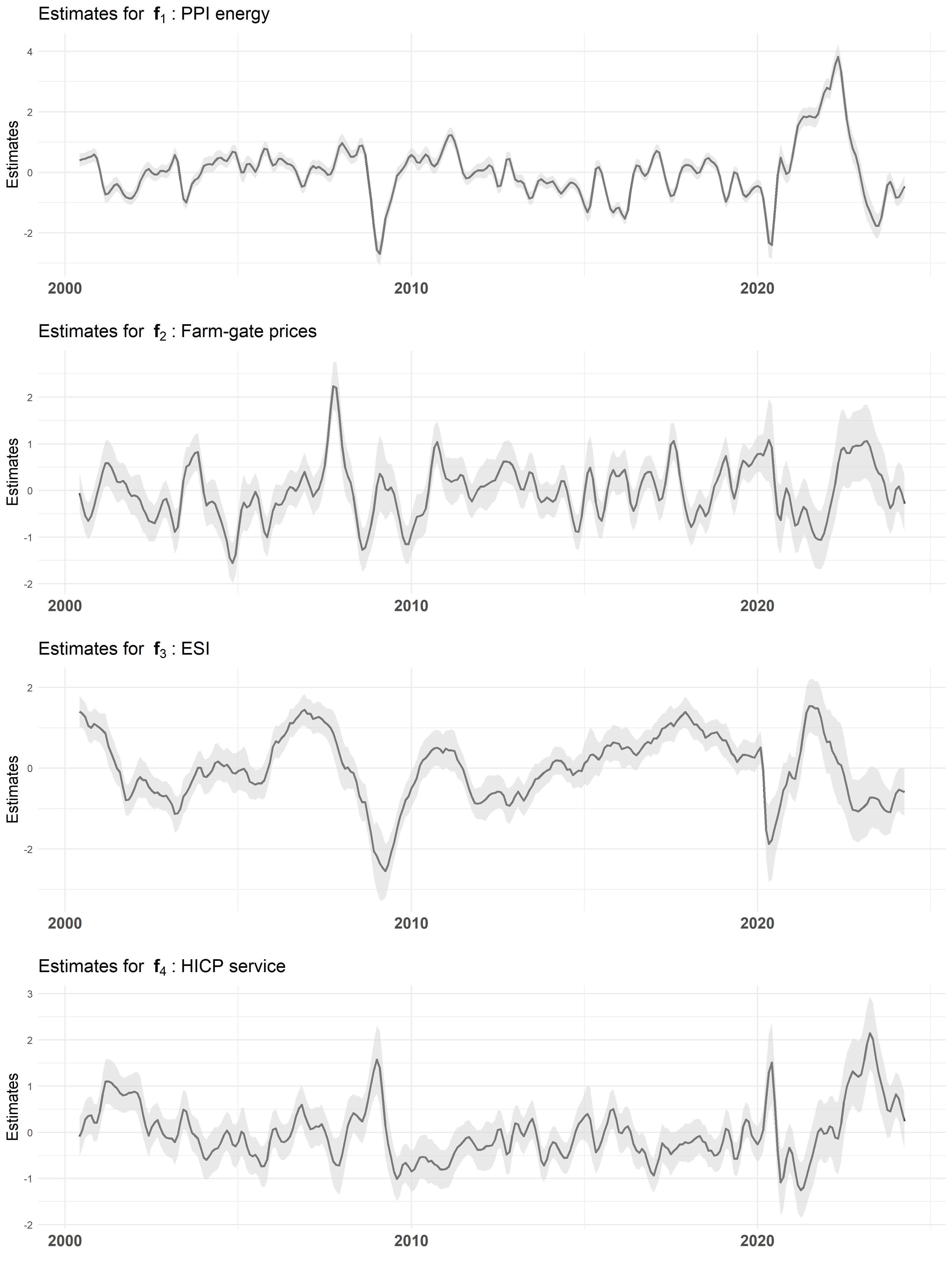

Factor Estimates

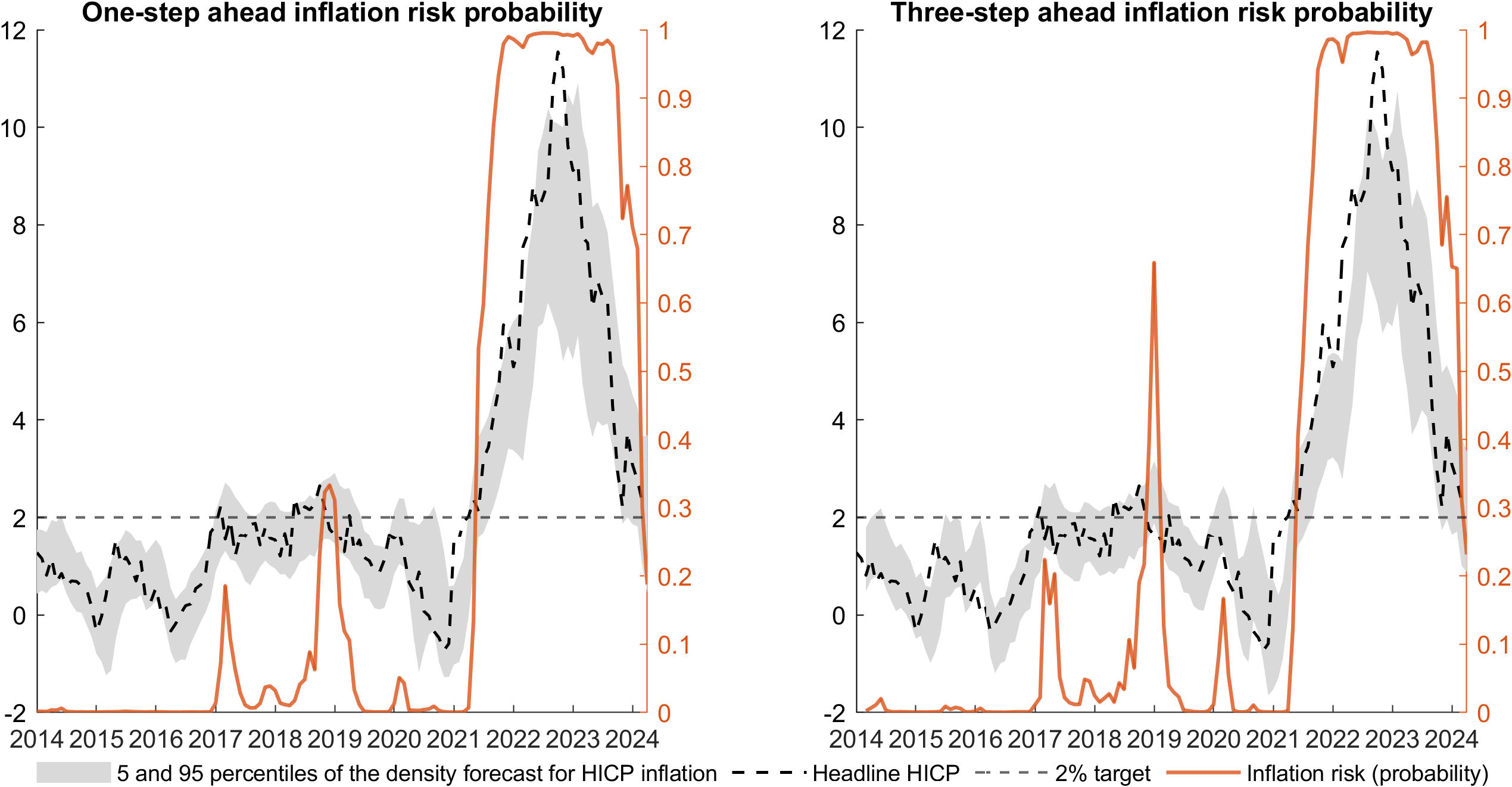

Inflation Risks for Germany

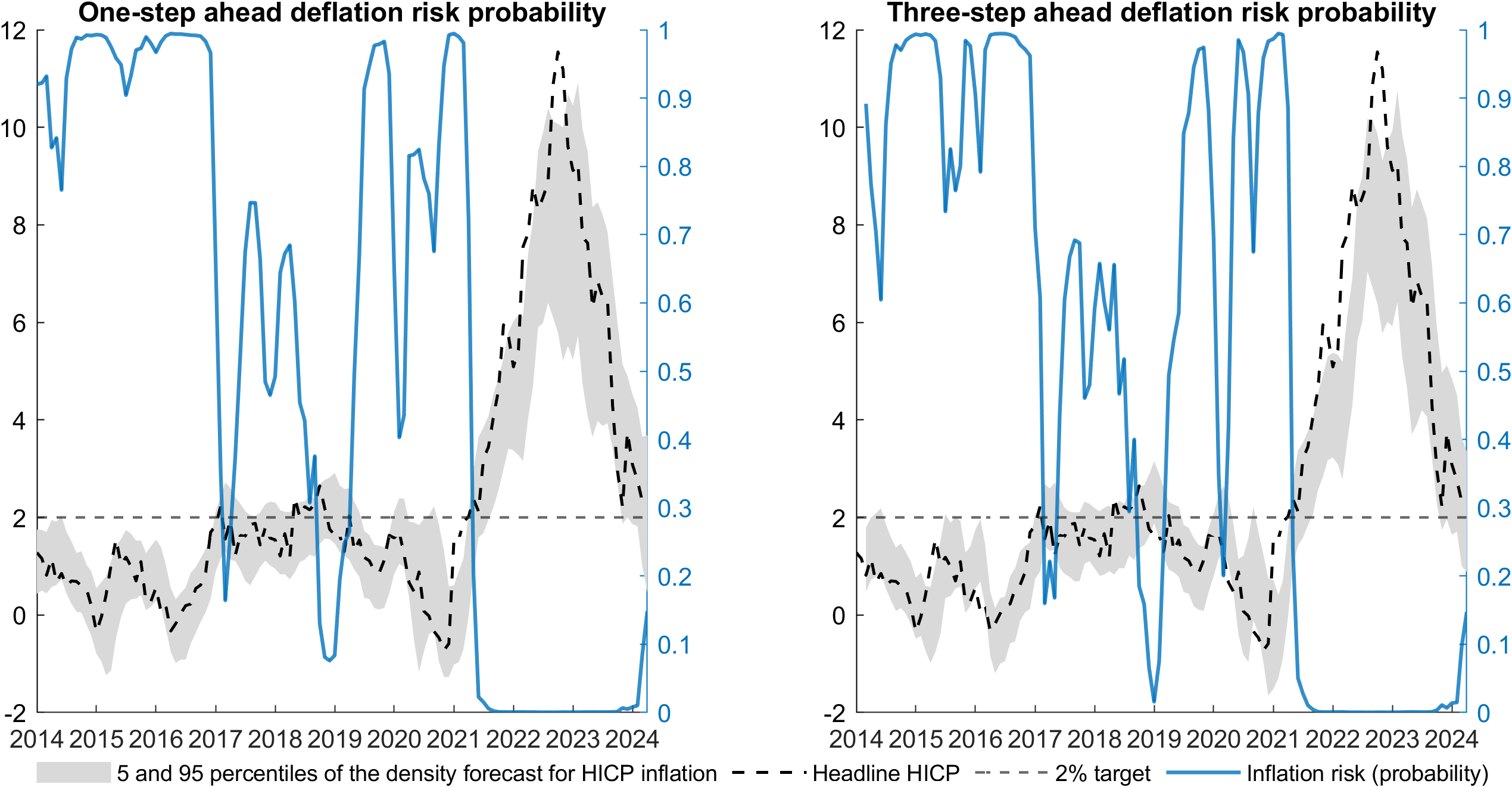

Deflation Risks for Germany